News

Stay informed and make informed financial decisions! This section provides valuable resources, including articles, business announcements, and helpful tips relevant to your financial journey. We update this page regularly to keep you informed about market trends, tax law changes, and other important financial news. If you need information not found here, contact us.

Search

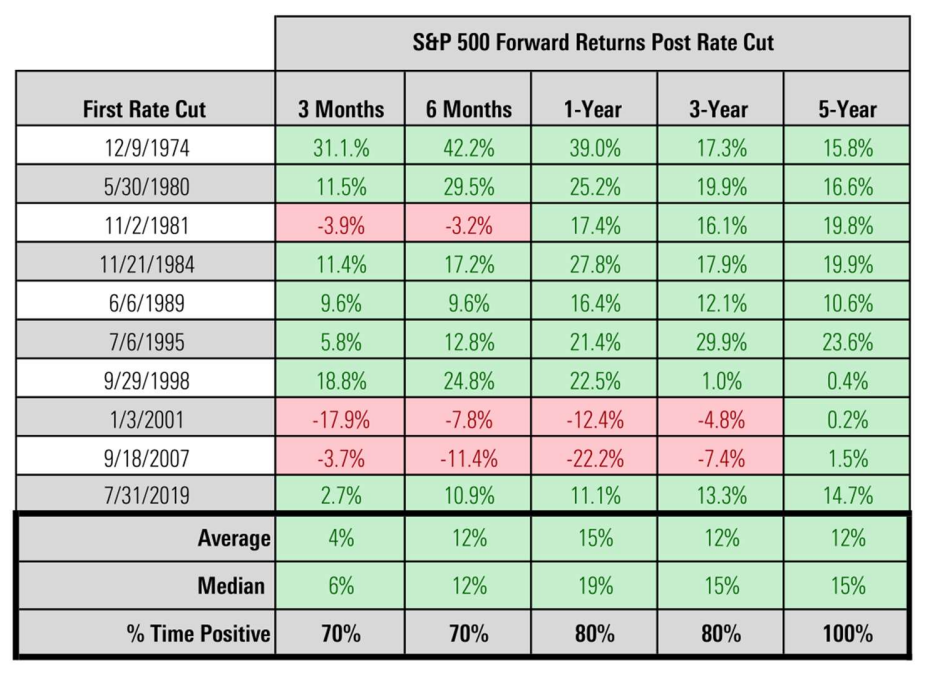

With the Federal Reserve poised to start cutting interest rates, experts are divided on what’s ahead for the U.S. economy. While some worry the economy could be in for a broad decline, or recession, others hope the central bank can effectively avoid a downturn and execute a “soft landing.” For people who are in or near retirement, the stakes are particularly high when it comes to what happens next. A recession or sudden market decline could upend the size of their retirement nest egg, planned retirement date or both. Everyone approaching retirement should be asking themselves, “What’s my Plan B?” said Anne Lester, author of “Your Best Financial Life” and former head of retirement solutions at JPMorgan. “Now is a great time to build some scenarios and start asking yourself that question, ‘What would I do?’” Lester said. “If you have a plan, you’re much less likely to panic and do something unwise.” Research shows people who are approaching retirement are much more likely to panic when a downturn sets in, according to David Blanchett, managing director and head of retirement research at PGIM DC Solutions. “Being proactive now is especially viable for older Americans for whom retirement is all of a sudden becoming very real,” Blanchett said. To test your current retirement plan, asking some questions can help. Is my portfolio allocated where it should be? For retirees and near-retirees, a market decline can prompt what’s known as sequence of returns risk — where poor investment returns negatively impact how long retirement savings may last. “If you are near the end of your career or just starting retirement and a recession hits, then you have much less time than you’d like for your portfolio to recover,” said Emerson Sprick, associate director of the Bipartisan Policy Center’s economic policy program. A market selloff can happen without the economy going into a recession, Lester said. And the economy can go into a recession without meaningful stock market declines. Consequently, it helps to always be prepared for the markets — and your retirement nest egg — to take an unexpected big hit. The good news is that it’s rare for the markets to have a big correction — defined as a decline of 10% or more — and keep sinking, Lester said. “It is very unlikely that we rerun 1929 again, where you have five or seven years of very bad returns in a row,” Lester said. More from Personal Finance: How investors can prepare for lower interest rates Why some investors shouldn’t max out 401(k) contributions ‘Was my Social Security number stolen?’ Answers to your data breach questions Certain rules of thumb aim to help gauge how much you should have allocated to equities, such as subtracting your age from 120. (For example, if you’re 50 years old, you should have 70% of your portfolio in equities. If you’re 70, equities should comprise only 50% of investments.) Yet it’s important to keep in mind that everyone’s financial situation — and ability to take risk — is different, based on their mix of assets, Blanchett said. Now can be a great time to get ahead of certain risks. “If you know, for example, if the portfolio goes down by 10% you’re going to move to cash, move to cash now before it’s going to do that,” Blanchett said. Government bonds also provide opportunities to earn returns that weren’t available two or three years ago, he noted. To avoid having to sell investments and lock in losses when the market declines, it helps to have a cash buffer you can turn to. For retirees and near retirees, having two to three years of spending in cash can be a solid approach, Lester said. What are my sources of income? Having income that’s guaranteed can help reduce the impact market fluctuations have on your portfolio. For most retirees, Social Security provides steady monthly checks. But if you claim at the earliest possible age — 62 — your retirement benefits will be permanently reduced. By waiting until full retirement age — typically 66 to 67, depending on date of birth — you will receive 100% of the benefits you’ve earned. And if you wait even longer — up to age 70 — you stand to increase your benefits by about 8% per year. “Now more than ever, delaying claiming Social Security is just a spectacular thing to start with,” Blanchett said. Individuals may also want to consider investing in an annuity, insurance products that also provide monthly income streams in exchange for an upfront lump sum payment paid to an insurance company. “The higher interest rates are, the better the payment stream is off an annuity,” said Lester, who also serves as an education fellow for the Alliance for Lifetime Income, a nonprofit formed to educate consumers on annuities. “Rates are likely to drop in the future, and lower interest rates are going to likely result in lower payouts for annuity,” Blanchett said. “So addressing this now vs. later will likely lead to more income, a higher return.” Certain products like multi-year guaranteed annuities and other fixed annuities can provide guaranteed returns in a tax-advantaged way for older Americans, he said. Before purchasing an annuity, consumers should do their due diligence as to whether a product fits their financial circumstances. Consulting a reputable licensed financial professional can help.

The passing of the SECURE 2.0 Act turned 529 accounts into an even more valuable savings tool for families looking to give the gift of education to their loved ones. With the new regulations, 529 account owners can now, subject to certain limitations, roll over 529 funds to a beneficiary-owned Roth IRA without being subject to taxes or penalties. Since they came into being in 1996, section 529 accounts have served as highly tax-efficient vehicles for funding a child’s education. Individual contributions to 529 accounts of up to $18,000 per year (or $36,000 per married couple) are not treated as taxable gifts to the beneficiary, the money in the account can grow tax-deferred, and some states even offer deductions on in-state plans. That said, the implications of possibly unused 529 assets is a source of uncertainty for some 529 account owners—particularly those who wonder what might happen to the funds if their loved one receives a scholarship, attends a less expensive school, or even decides to forego college altogether. Fortunately, there is welcome news for families concerned about overfunding 529 accounts. The recently passed SECURE 2.0 Act now provides families the option to use leftover 529 funds to help kids save for retirement. More specifically, the Act includes a provision that, as of January 1, 2024, allows 529 account owners to transfer funds to a Roth IRA without incurring taxes or penalties. Previously, a 529 account owner or beneficiary who wanted to withdraw funds for any non-qualified education expense would be subject to income taxes and a 10% federal tax penalty on earnings. This is an exciting development for families that adds to the list of reasons to save with 529 plans. The new feature, however, is subject to some limitations: Contribution limits: Rollover amounts cannot be greater than the annual Roth IRA contribution limit set by the IRS. In 2024, that amount is $7,000, plus an extra $1,000 catch-up allowance for individuals over the age of 50. The beneficiary must have earned income that is equal to a greater than the amount to be rolled over. There is also a $35,000 lifetime limit per beneficiary for rollover contributions to Roth IRAs. Holding periods: The 529 account holder must have owned the 529 for at least 15 years prior to executing a rollover. Furthermore, contributions made to the 529 account within the last 5 years are not eligible for the tax-free benefit. Ownership: For a tax- and penalty-free rollover, the 529 beneficiary and the owner of the Roth IRA must be the same person. It is advisable to discuss your specific circumstances with a financial or tax professional before executing a rollover, as there are grey areas in the new statute that remain open to IRS interpretation. For example, it remains unclear whether a change of beneficiary in a 529 account—currently permissible at any time—will reset the 15-year holding period requirement. In addition, the state tax treatment of rollovers may vary from state to state. Despite some of these limitations, families should feel encouraged that 529 plans continue to evolve in their favor, and that they now have more options to tax-efficiently support their loved ones, no matter what the future may bring.

Later this year, SIMPLE IRA Plus plan sponsors will be able to offer participants more ways to save for retirement by adding Roth after-tax deferral contributions as a plan feature. Driven by the SECURE 2.0 Act of 2022, Roth employee deferrals are an optional plan feature available to new plans effective May 1, 2024. Existing plans can add the feature for the 2025 plan year. To take advantage of these capabilities: New plans must select Roth elective deferrals in their plan adoption agreement. Existing plans must amend and restate their adoption agreement prior to November 2 and notify participants of this change prior to the annual enrollment period, which will run from November 2 through December 31. Learn more about amending and restating SIMPLE IRA Plus plans. We’ll notify existing SIMPLE IRA Plus plan sponsors of these enhancements. Additionally, we’ll provide these plans with the steps required to amend and restate their adoption agreements, including the appropriate notification documents to participants, prior to the annual enrollment period. We’re also evaluating recent guidance on employer Roth contribution, and we expect to introduce Roth contribution options for other SIMPLE IRA products later this year. We plan to communicate more details about these options at a later date. Please visit our account resource center for additional assistance with your SIMPLE IRA Plus plans. You can also learn more about the status of our support for SECURE 2.0 provisions. Frequently asked questions General What’s driving the availability of Roth for SIMPLE IRAs? Section 601 of SECURE 2.0 Act of 2022 allows plans to offer Roth employee and employer contributions for SIMPLE IRAs and SEP IRAs for plan years beginning after December 31, 2022. What’s Capital Group’s plan for introducing Roth contributions to SIMPLE IRA plans? We plan to introduce Roth employee deferrals to SIMPLE IRA Plus starting May 1, 2024. We’re also evaluating recent guidance on employer Roth contribution, and we expect to introduce Roth contribution options for other SIMPLE IRA products later this year. We’ll communicate more details about these options at a later date. SIMPLE IRA Plus What’s required for plans to offer Roth employee deferrals? New plans must select Roth employee elective deferrals in their plan adoption agreement. Existing plans must amend and restate their adoption agreement prior to November 2 , and notify participants of this change prior to the annual enrollment period from November 2 through December 31 . We’ll share more information with plan sponsors, including the required steps to add a Roth option to an existing plan, later this year. Note: All employer contributions must be made on a pre-tax basis at this time. We’re working on updating our recordkeeping system to accommodate Roth employer contributions and expect to communicate more information soon. Are plans required to offer Roth employee deferrals contributions? No, this is an optional plan feature.

Investing during an election year can be tough on the nerves, and 2024 promises to be no different. Politics can bring out strong emotions and biases, but investors would be wise to put these aside when making investment decisions. Benjamin Graham, the father of value investing, famously noted that “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” He wasn’t literally referring to the intersection of elections and investing, but he could have been. Markets can be especially choppy during election years, with sentiment often changing as quickly as candidates open their mouths. Graham first made his analogy in 1934, in his seminal book, “Security Analysis.” Since then there have been 23 election cycles, and we’ve analyzed them all to help you and your clients prepare for investing in these potentially volatile periods. Below we highlight three common mistakes made by investors in election years and offer ways to avoid these pitfalls and invest with confidence in 2024. Mistake #1: Investors worry too much about which party wins the election There’s nothing wrong with wanting your candidate to win, but investors can run into trouble when they place too much importance on election results. That’s because elections have, historically speaking, made essentially no difference when it comes to long-term investment returns. “Presidents get far too much credit, and far too much blame, for the health of the U.S. economy and the state of the financial markets,” says Capital Group economist Darrell Spence. “There are many other variables that determine economic growth and market returns and, frankly, presidents have very little influence over them.” What should matter more to investors is staying invested. Although past results are not predictive of future returns, a $1,000 investment in the S&P 500 Index made when Franklin D. Roosevelt took office would have been worth almost $22 million today. During this time there have been eight Democratic and seven Republican presidents. Getting out of the market to avoid a certain party or candidate in office could have severely detracted from an investor’s long-term returns. By design, elections have clear winners and losers. But the real winners were investors who avoided the temptation to base their decisions around election results and stayed invested for the long haul. Stocks have trended higher regardless of which party has been in office